One of the main concerns that people have when thinking of leaving teaching is the financial implication. Money worries are one of the main barriers to leaving teaching, and many will remain in a toxic work environment, in a job they hate and which is making them ill, because they insist, “I can’t afford to take a pay cut!”

“I’m desperate to jump but have so many anxieties about making the leap. The time pressure doesn’t help. I know I can’t be there in September for my own sanity so searching for jobs and stressing about deadlines for applications. Worrying about making the wrong decision just to get out quick. Loss of pay. All a massive worry. But the long and short of it is, I can’t continue.”

Comment from Thinking of Leaving Teaching?.

You may be thinking of going part-time, doing supply teaching or getting a job outside of teaching. However, the reality is you most probably won’t find a job that pays as much as your teaching job to begin with especially if, like me, you were UPS3 with responsibilities. In response to the common retort, “I can’t afford to take a pay cut!”, my question is, “Have you actually written down your outgoings? Many people haven’t.

“People just say that they couldn’t possibly earn less because there is absolutely nothing that they could give up/change.

Comment from Thinking of Leaving Teaching?

I spent about 4 years applying for jobs I wanted, but was never going to get and I still chance my arm at the odd one, because well… you never know. Once I was truly ready, I applied for realistic jobs and was offered them.

You become more realistic when you’re ready.

The reality is that there are many things that people spend their money on that are non-essential. For example, I know people who buy a £3 coffee every morning before work. That’s £15 per week, £60 per month, and over £650 per year… just on a morning coffee! Their gym subscription, that they rarely make use of because they complain of being too busy, is £75 per month which is £900 per year. They could get cheap gym membership by joining no contract gyms and pay £20 a month or less, a saving of £660. There are plenty of other ways that people can save money.

“So much happier! It’s amazing how you can reduce spending if you need to: we eat out far less, don’t buy expensive branded clothing anymore, drive older cars and only buy what we need rather than want.”

Comment from Thinking of Leaving Teaching?

Analysis of my spending habits back then shows just how much money I wasted. I was a classic victim of Parkinson’s Law:

“No matter how much money people earn, they tend to spend the entire amount and a little bit more besides. No matter how much they make, there never seems to be enough.”

How Parkinson’s Law relates to money

Don’t fixate on salary!

Possibly the biggest mistakes that teachers make when thinking of leaving teaching is creating a barrier to happiness by becoming fixated on salary.

I left teaching back in December 2023 when I was Head of Department on UPS3 +TLR1. I am now a Learning Technologist at a university and earn approximately £7,400 per year less than when I was Head of Department. However, once Tax, Pension and National Insurance are deducted, my net monthly salary now is only around £117 less than it was when I was Head of Department.

In my last year as a teacher, I was paying approximately £526 monthly into pension and AVCs (Additional Voluntary Contributions). Now, I pay approximately £186 into my pension, but the University contributes approximately £310, giving a total of approximately £496 monthly into my pension… just £30 less per month than was going into my pensions as a teacher!

If you work out my hourly rate, I was working a minimum of 55 hours per week as a teacher giving an hourly rate before tax of approximately £15.57. In my current job, my hourly rate works out at approximately £19.28/hour because I work fewer hours.

What makes a difference is that I now work from home. That means I am saving over £2000 per year, or at least £170 per month, in fuel.

In other words, despite my salary being approximately £7400 per year less than it was when I was Head of Department on UPS3, on paper (after tax) it shows that I have more £50 more disposable income every month and am actually £50 a month better off. Obviously, this is a direct comparison of payslips. I am not saying that I am earning more than if I’d stayed as Head of Department. I would be earning a lot more if I’d stayed! What I am saying is don’t fixate on the salary figure as there may be other benefits.

Person A on £40,000 salary

- Travels to work everyday

- 10 hours per week of travel by car

- Spends £150/month in fuel to work

- Company contributes 5% to pension

Person B on £38,000

- Works from home

- No travel time

- Spends £0/month travelling to work

- Company contributes 10% to pension

Despite Person A having a higher salary than Person B, Person B is clearly better off, both financially and in time. When you are searching for a job, the biggest mistake that you can make is not considering jobs that are less on paper than you currently earn as a teacher. There are many other factors that you must take into consideration.

Useful websites

If you are looking at other jobs, you can use one of the many Salary Calculator tools to work out the net monthly income (after tax) from the gross annual salary stated in the job advert.

Money Saving Expert Income Tax Calculator

For example, a job offering a salary of £25,000 a year will give a net monthly income of £1,752 in the 2023/24 tax year.

Another useful resource is the Government’s Money Helper website which has a section on How to make a budget, and deals with topics such as Help with the cost of living, Dealing with debt and Money problems and complaints.

Reducing money worries by budgeting

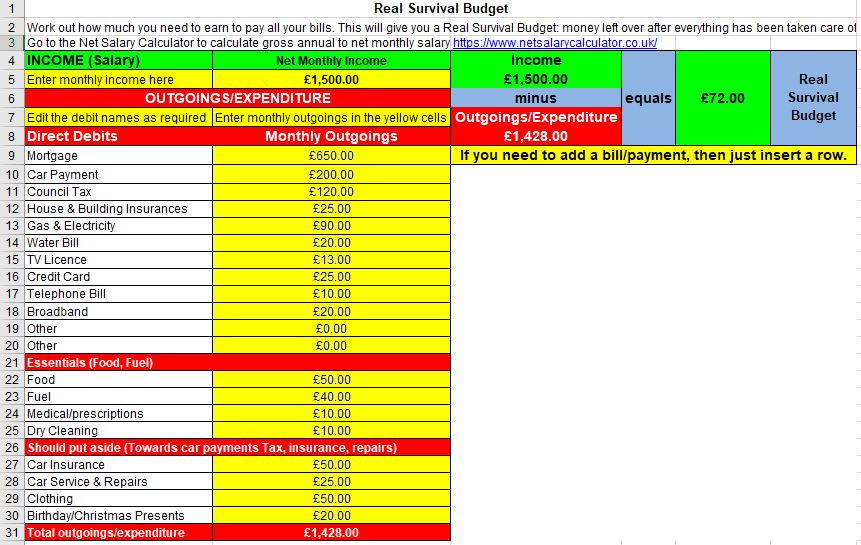

Thankfully, my understanding of the value of money has improved since then and I have learnt the difference between what I need and what I want. One thing that helped me was creating an “Income & Expenditure Real Survival Budget” spreadsheet. I entered my mortgage, bills and all other outgoings on this spreadsheet and it told me how much I needed to earn to cover them. After entering the monthly salary, it works out how much money you have left over.

Knowing both the net monthly salary of a potential job and your expenditure will tell you whether or not you can afford the pay cut. You can download this spreadsheet by clicking on the Download button.

Real Survival Budget

In the above Income-Expenditure spreadsheet, if you have a surplus, the cell next to Real Survival Budget turns green, and if your expenditure is more than you could be earning then the cell turns red.

Bizarrely, like in the comment above, I also manage to save more money now than I did when I earned a Head of Department salary on UPS3 and I even make over-payments on my mortgage. Despite initial concerns about money, I am so much happier now. I have no money worries and no regrets about leaving teaching. Others have reported similar:

“Firstly the tip, something to remember is that the percentage contribution of your salary for a teacher is really quite high, especially if you are in the upper pay brackets. So if you have to take a pay cut your take home may not be as drastic as you imagine because your pension contribution in your new job will likely be much lower.“

Comment from Thinking of Leaving Teaching? Group

“I used to bring home £2,450 a month when teaching but always had an over draft.

Comment from Thinking of Leaving Teaching?

Was stressed 24/7,on anti depressants and had no time for friends or family.

Now as a dementia carer I bring home £1,300 a month.

I don’t have an overdraft.

I actually have money at the end of the month. I no longer take anti-depressants. I spend quality time with my family and friends. I have hobbies again and my quality of life is priceless.

I can’t get the time back I spent worrying or fretting or laminating resources or marking etc at home when I should have been enjoying family life but I can make up for it now.“

“Part of the “fun” as well is that you start to really appreciate the extra funds when you get a bonus or pay rise rather than just spending and not saving so much. I left 3 years ago and am just back to my old teaching salary but have bought a car, got a new bathroom and boiler and about to get a fancy new roof and kitchen!!! All things we could “never afford” before.“

Comment from Thinking of Leaving Teaching? Group

If you’re thinking of leaving teaching then the Thinking of Leaving Teaching Group might be a good place to get some ideas. It is a safe place for people to ask for help and advice, discuss topics and share opinions about jobs you can do if you leave teaching.